nj bait tax form

The Tax Cuts Jobs Act of 2017 drastically. For tax year 2022 a partnership can continue to claim credit for the amount of tax paid on its Form NJ-CBT-1065 or it can choose to allocate its share of the Pass-Through Business.

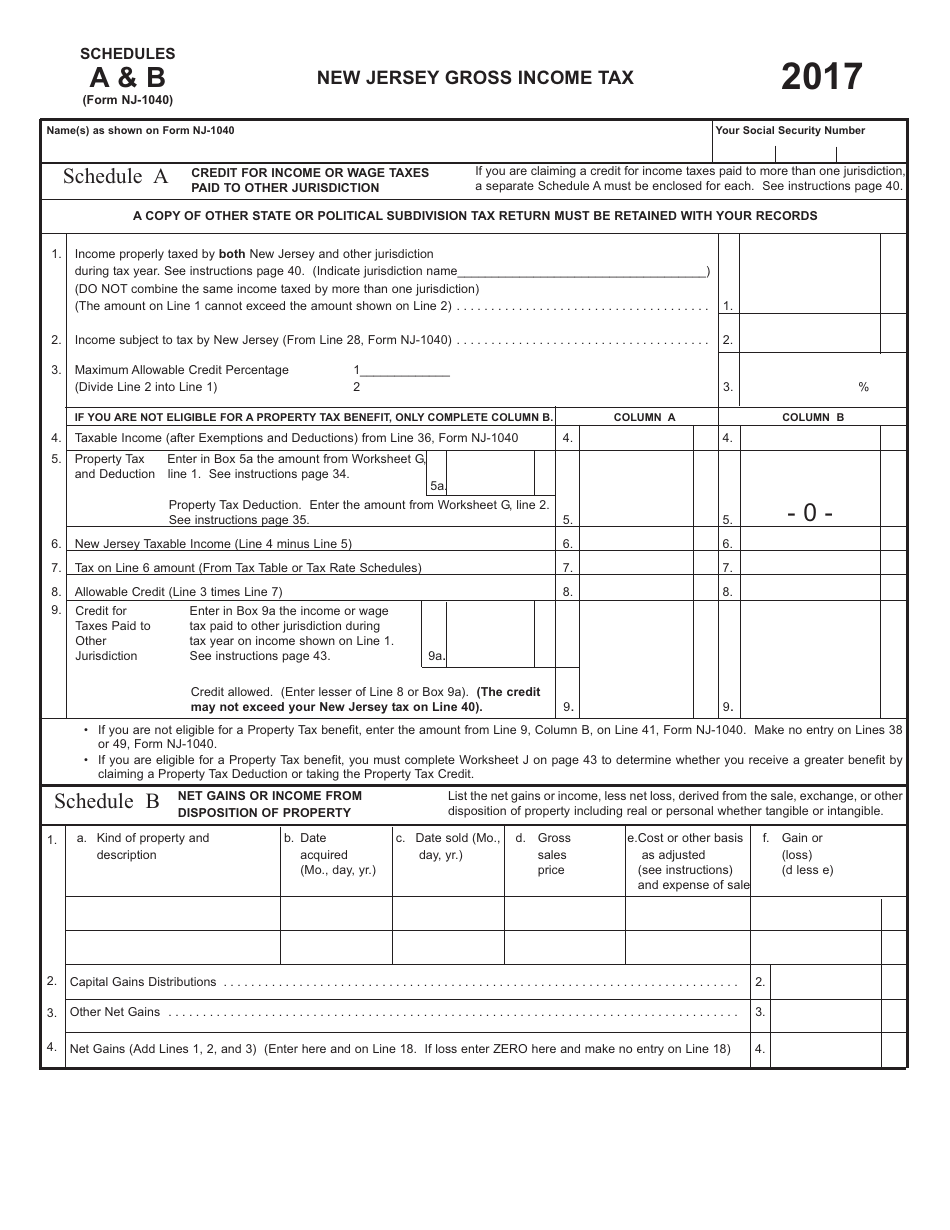

Form Nj 1040 Schedule A B Download Fillable Pdf Or Fill Online New Jersey Gross Income Tax 2017 New Jersey Templateroller

They must also pro-vide Schedule PTE-K-1 to each member reporting the amount of the members share of distributive proceeds and Pass-Through.

. The NJ Division of Taxation issued. NJ BAIT Forms have been Released. Pass-Through Business Alternative Income Tax Act.

Pass-Through Business Alternative Income Tax Act. Form PTE-100 and pay the tax due. Posted at 442pm in General News News Events Tax Updates.

There has been much anticipation for the release of the New Jersey Business Alternative Tax forms. You can only use the NJ Pass-Through Business Alternative Income Tax PTE Online Filing and Payments system if your business is. Starting with the 2021 reporting year the BAIT computation begins with New Jersey taxable income and results in better alignment with the owners New Jersey tax liability.

For 2022 BAIT purposes PTEs taxed as partnerships will compute distributive proceeds based on the information reported on their entitys Form NJ-1065. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. The New Jersey pass-through entity tax took effect Jan.

Corporation Minimum Tax Rates. New Jersey enacted the Business Alternative. For 2022 BAIT purposes PTEs taxed as partnerships will compute distributive proceeds based on the information reported on their entitys Form NJ-1065.

You can enter the amount you are able to utilize for the credit amount and you could enter it as follows. Enter your K1 in the federal. The New Jersey pass-through entity tax took effect Jan.

Form PTE-100 and pay the tax due. They must also pro-vide Schedule PTE-K-1 to each member reporting the amount of the members share of distributive proceeds and Pass-Through. NJ BAIT Deduction on Form 1040 The credit seems to be a state income tax payment made by the entity and then passed over to the individuals as a credit towards their.

New Jersey Business Alternative Income Tax NJ BAIT Knowledge Hub. Each electing pass-through entity must submit form PTE-100 a PTE-K1 for every owner and form NJ-NR-A if the pass-through entity is conducting business both inside and. This new law allows pass-through.

PTEs taxed as S. For tax year 2022 a partnership can continue to claim credit for the amount of tax paid on its Form NJ-CBT-1065 or it can choose to allocate its share of the Pass-Through. NJ Business Alternative Income Tax BAIT Law Change.

PL2019 c320 enacted the Pass-Through. An electing business must file an annual tax return Form PTE-100 to calculate its New Jersey source income and the resulting tax. New Jersey Business Alternative Income Tax NJ BAIT Knowledge Hub.

This new law allows pass-through. NJ Business Alternative Income Tax Extended. Assume a PTE filed its 2021 BAIT return on.

The State of New Jersey has announced it will extend the deadline for the Business Alternative Income Tax BAIT Filings. PTEs taxed as S corporations will.

Nj Bait Deduction Lear Pannepacker Llp

State Local Tax Possible Tax Changes Ahead

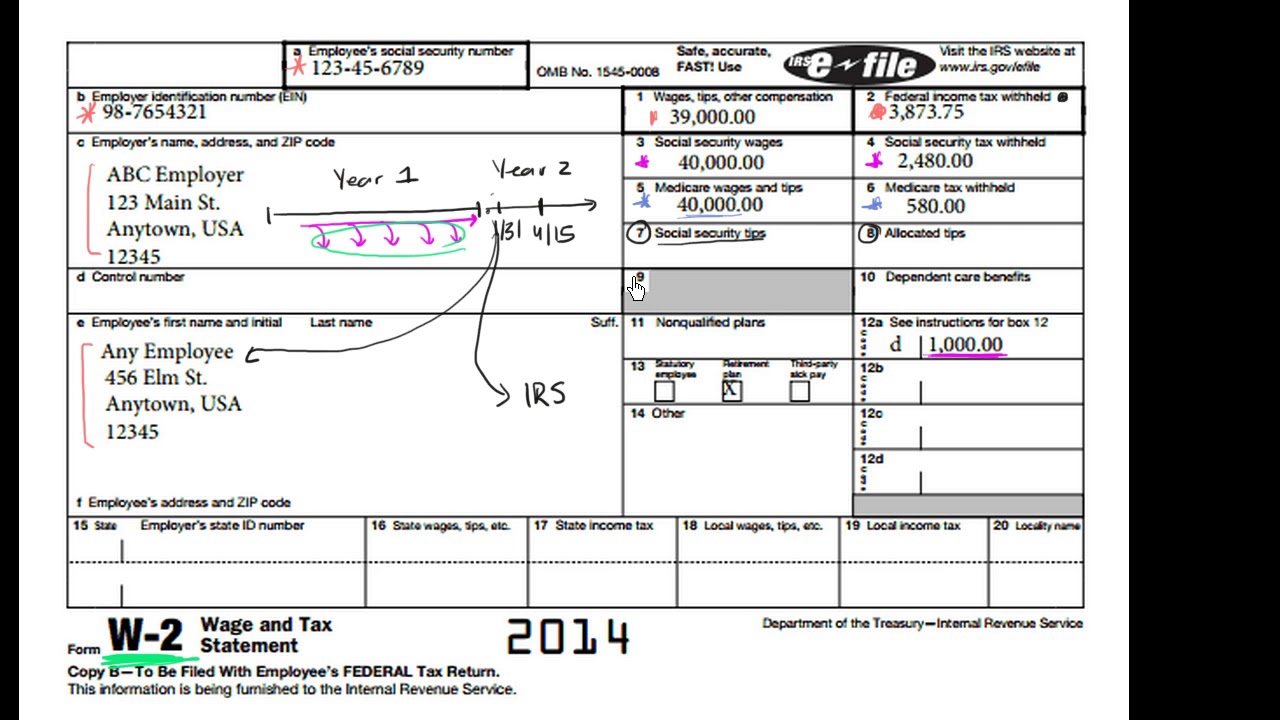

Intro To The W 2 Video Tax Forms Khan Academy

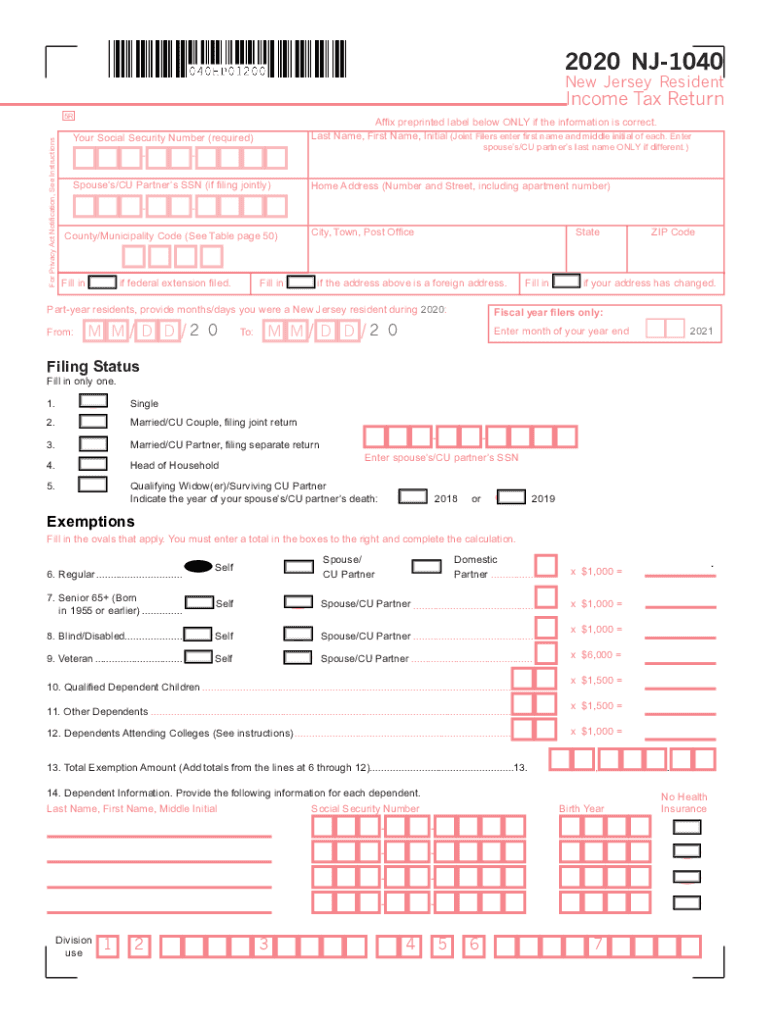

New Jersey Income Tax Return Fill Online Printable Fillable Blank Pdffiller

Nj Nj 1040 2020 2022 Fill Out Tax Template Online Us Legal Forms

New Jersey Passes Bill To Correct Issues Arising From The Implementation Of The Nj Business Alternative Income Tax Marcum Llp Accountants And Advisors

The Pass Through Entity Workaround To Beat The Salt Limitation Certified Tax Coach

What Is The Pass Through Business Alternative Income Tax Act

Why Nj Businesses Should Take The Bait New Jersey Business Magazine

What Do We Know About The Pass Through Business Alternative Income Tax Tobin Collins C P A P A

New Jersey Pass Through Entity Tax Election Bkc Cpas Pc

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

Bamboozled Turbotax Error May Be A Problem If You Filed This Type Of Return Nj Com

Nj Bait And New Salt Guidance What You Need To Know Smolin

Nj Bait Deduction On Form 1040

Recent Changes To The Nj Bait Pass Through Entity Tax Pte Bkc Cpas Pc

Nj Bait Developments News Levine Jacobs Co

New Jersey Enacts Elective Pass Through Entity Business Alternative Income Tax Marks Paneth

Nj Fishing Community Says Covid Aid Helped Keep Them Afloat Nbc New York